The CAIA exam focuses on alternative investments and if you are new to the industry or to the subject, you might come across quite a lot of new terms. I have compiled a list of some terms that you might find useful in your studies.

2/20 (two and twenty): this refers to the fee structure that is charged by hedge funds. The 2 refers to the recurring 2% management fixed fee that is charged as a % of assets held. The 20 instead refers to the 20% fee that is charged on any investment returns.

Accredited Investor: accredited investors are individuals who are allowed to invest in sophisticated investments such as hedge funds, VCs, private placements, etc. In order to be classed as such, accredited investors need to meet a number of criteria such as having a net worth of $1,000,000 or having an income of at least $200,000 (these criteria might vary based on the country).

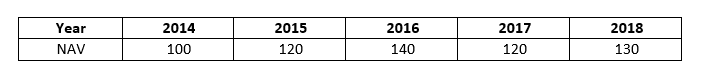

High-Watermark: this is the highest fund value reached by a fund. High-Watermarks are very important when we are talking about performance returns that are paid out to hedge fund managers. Let’s look at the below example:

Assuming a fund’s NAV (Net Asset Value) at inception in 2014 is 100 we can see that in 2015 it had a return of 20% and the NAV grew to 120. The fund will take 20% of the 20 that it made in profit (Year 2 NAV – Year 1 NAV which is equal to 120 – 100 = 20 from the table above). Therefore 120 is the High-Watermark at this stage.

Similarly, in the following year it rose again by 20 and now the returns are calculated in terms of any gains made above the High-Watermark of 120 so (140-120)*20%, the new High-Watermark now becomes 140.

In the following year we can see that the fund didn’t have such a great year and it’s NAV fell to 120. No performance fees will be paid as the NAV value was below the High-Watermark. If we look at the next year we can see that the fund posted some gains from 120 to 130 but still this is below the 140 High-Watermark so no performance fees arise.

CTA: stands for commodity trading advisor. This is a term used to define a hedge fund that aims to generate returns via futures, options and forex trading.

Vintage: vintage refers to the year when the VC fund was set up. When you are comparing returns of VC funds, it’s very important to compare two funds that have the same vintage. Fund performance will be hugely affected by the prevailing economic conditions from when the fund was set; comparing two funds with the same vintage allows us to make a fair comparison.

General Partners vs. Limited Partners: you will come across these terms when looking at private equity. The general partner will be involved in the day to day running of the VC firm where he or she will manage the projects and decide which projects to invest in. Limited partners on the other hand are not involved in running the VC firm but instead they provide the funds that the General Partners put to use to increase the value of the firm.

Cap Rate (Capitalization Rate): you will come across this term in real estate and you can interpret it as the yield that your property is offering. The Cap Rate is obtained by Net Operating Income (NOI)/Property Value.

REIT: stands for Real Estate Investment Trust. A REIT is a company that owns and operates a real estate portfolio. Real estate could range from warehouses, hospitals, commercial properties, residential properties and more. REITs are listed on exchanges and investors can buy REITs just like ordinary common stocks. REITs tend to have inflows of cash flows in terms of rent paid by tenants and this allows for such returns to be paid out to investors in the form of hefty dividends which could range from 2-6%. They could be a good for income generation and moderate inflation protection. REITs are sensitive to economic conditions and fluctuations in the property market.