On 6th June 2021, I sat level 2 of the CMA exam. For those of you who are not familiar with this exam, CMA which stands for Certified Member Analyst is a financial analyst exam administered by the Securities Analysts Association of Japan. There is a big overlap with the CFA exam and the qualification is very well respected in Japan. I would say that most financial professionals in the industry possess this qualification. I introduced level 1 in a past post which you can access here.

Candidates who pass level 1of the exam can apply to receive the learning materials for level 2 and will then have three attempts to take within three years. Should a candidate not pass the exam in the 3 attempts, they will need to re-apply to study the level 2 curriculum otherwise they will need to re-start from scratch by having to retake level 1. This is a very important point to be aware of if you are registered to take this exam.

Tag Archives: CMA

Taking the 2019 Autumn CMA Exam in New York

Over the past months I have been preparing for the CMA (Certified Member Analyst of the Securities Analysts Association of Japan) exam and although this is a Japanese exam, they have test centres in London, Hong Kong and New York.Since I had some holidays booked to visit the US at the end of September, I opted to take the test in New York and so in this post I would like to share my experience.

Preparation

The exam is comprised of three sections: Accounting, Portfolio Management and Economics (you can read more about the structure of the exam here) and I had registered this time to take the Accounting portion since I had taken the remaining two parts in Japan. In preparing I made sure to go through past exam questions and practice questions. If you are enrolled for the exam you will have access to past exam papers from 2014 – from your MyPage Account. The below book by TAC is also widely used by candidates in their preparations; the book has the same past exam questions that you can access from your MyPage however the questions are neatly categorised based on topics and the answers are more thorough compared to what you will see from the institute papers.

Having seen numerous solved past papers OR Having seen and completed numerous past papers, I can say that the format has remained unchanged for years so if you have done your prep you shouldn’t have/experience any big surprises on test day.

Here is how the exam is structured:

Part 1 (concept checkers: 17 questions) In this section you will get conceptual questions on ALL topics and there will be no calculations involved. You will pretty much know straight away whether you know the answer, or you should at least be able to narrow down your answer to make an educated guess. Unlike parts 2,3,4 this part is difficult to prepare for given the breath of the topics.

Part 2,3 (calculation questions: 15 questions) The calculation questions which come up in these sections are pretty repetitive so this part should allow you to pick up a lot of points. Lease Accounting, Tax, Pension Accounting, Equity Valuations, Inventory Accounting are some of the most popular topics tested in this section.

Part 4 (financial statement analysis: 26 questions) In this section you are given a Balance Sheet and an Income Statement and you are asked to calculate a lot of financial ratios. Be sure to know how to calculate ROE (Du Pont Analysis), ROA, Efficiency Ratios, Safety Ratios, etc..

Please note that just like the other level 1 exams the entire Accounting Exam is also multiple choice based.

My Strategy

I did a lot of research to see how people tackled this exam and a lot of candidates recommended tackling the exam in the following order: Part 4, Part 2,3 and lastly Part 1. The format for Part 4 has remained unchanged in the last years so as long as you remember the formulas for the ratios and where to look for in the financial students for the relevant information, you should be able to get most of the points. When calculating ROE or any ratio that mixes income statements and balance sheet items, remember to take the average of the two fiscal periods for balance sheet items. For example, if you are calculating ROE (Net Income/Equity) for period T, make sure to calculate the Equity part in the denominator as Equity = (Equity_T-1 + Equity_T)/2.

Other than that, the rest is a lot of number crunching so being able to quickly compute ratios on your calculators should be very helpful. For the exam I chose to use the HP12C calculator which I also used throughout my CFA exams. I focused most of my energies on this part and aimed to get 100%.

Parts 2 and 3 have a bit more variety compared to part 4 but these questions should have popped up in past exams. I stepped in the exam room aiming to get around 70%+ in this section.

Finally, we come to Part 1 or I should call it the ‘wordy concept checker’ section which no one seems to like, myself included. Assuming I got most of my points from the remaining sections, I didn’t bother spending too much time here and aimed to get around 50%

Exam Day

Exam day was a perfectly sunny day, a day I would have preferred enjoying in Central Park rather than taking a Japanese financial analyst exam. The test centre was at the Silberman School of Social Work in East Harlem and my hotel was close to Time Square so I ended up getting the NYC metro from the Grand Central Terminal.

I had taken the exam in Tokyo and sitting it in Harlem it was a completely different experience compared to sitting the exam in Aoyama Gakuin or Waseda. New York was much less chaotic, and I was surprised to see that only 5 other candidates were taking the exam. Slight jet lag aside, I thought it was quite a fair exam and I stuck to my strategy of solving the numerical parts first and leaving the wordy Part 1 until last.

Although I have not yet received an official email from the institute, based on past years we can I expect results to come out in the first week of November. I felt very relieved after the exam and I did manage to go and spend some time in the sun enjoying Central Park.

Introducing the CMA Exam (Certified Member Analyst of the Securities Analysts Association of Japan)

Having lived in Japan for over 3 years now and having spent some time preparing for this exam, I thought it would be worthwhile writing about it. This is a Financial Analyst exam administered in Japanese twice a year by the Securities Analysts Association of Japan. To qualify for the charter, you will need to pass levels 1 and 2 and have 3 years of qualifying work experience. It goes without saying that if your Japanese is not near-native level you will find this exam quite tough.

This is the Institute’s Official Page in English.

How respected is it?

Having met numerous professionals in the financial industry here in Japan, I must say I was surprised by the number of people who have the letters CMA on their business cards. In terms of prestige I would compare it to the CFA, although the CFA is regarded more highly due in part to the perceived difficulty with regards to the English language barrier that some Japanese might face.

Registering for the Exam

Registering to take the programme costs 50,300 JPY for members and 56,500 for non-members. Once you are registered for the exam you will be sent the institute (institution?) materials as shown in the below image.

You will then have 3 years to pass all the required exams. Since you can take the exams in both autumn and spring, that gives you 6 attempts to pass. If you don’t pass within those allotted 6 attempts, you will need to pay the registration fee again.

Level 1 Topics

Level 1 is comprised of 3 topics: Economics (1.5 hours), Accounting (1.5 hours) and Portfolio Management (3.0 hours). You can take ALL 3 exams on the same date or you can take the exams separately.

Economics: microeconomics (supply & demand curves), macroeconomics (ISLM curves, Fiscal and Monetary Policy), FX theory (PPP, IRP).

Accounting: basic financial statements, asset accounting, debt accounting, leases, pension accounting, parent accounting, tax accounting, ratio analysis.

Portfolio Management: portfolio management (Markowitz theory), DDM, CAPM, Free Cash Flows, Residual Income, Derivatives, Fixed Income Pricing.

Level 2

Level 2 from what I have heard is a written exam (a bit like the CFA level 3 constructive response) and I will cover this in more detail in a future post.

Popular Learning Materials

As far as I have seen, TAC seems to have the monopoly when it comes to learning materials for this exam. I would recommend purchasing the below learning materials. The smaller books contain summaries of the topics and the bigger books contain practice questions that are based on past exam papers (the institute discloses past exam questions).

What are the Pass Rates?

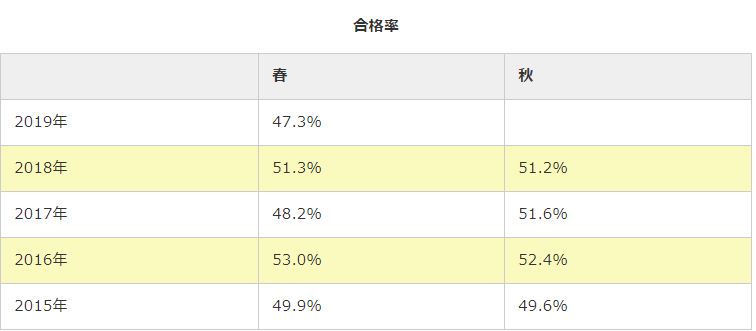

These are the pass rates for the last 5 years, as you can see roughly 50% of the candidates pass.

Final Thoughts

Having almost completed the level 1 exam, I must say that it is not impossible to pass. This is especially true as unlike the CFA, you have a big advantage that you can take the exams individually. You also have specific types of questions that reoccur, so practising as many questions as possible helps. A Japanese candidate would tend to spend 1-6 months preparing for the exam depending on their background. I think the average (non-Japanese?) candidate working in the financial sector should need 3-4 months to be comfortable in his/her preparation. If you are considering taking the exam and have any questions please do not hesitate to contact me!