In this post I will present to you my yutai stock picks for July and August 2020. It’s worth noting that July wasn’t a yutai heavy month, especially compared to August and September. Yutai investing might be fun but without wanting to sound too repetitive, I always like to add as a disclaimer that you shouldn’t just pick a stock solely because of its yutai. Rather yutai should just be considered as a perk in addition to the underlying return opportunities that the stock presents. Needless to say, given the uncertainty surrounding financial markets and COVID cases rising in Japan, I would be cautious before making any new purchases.

Tag Archives: Japan

5 Popular Stocks in Japan that Offer Yutai Gifts (June 2020 Update)

A year ago I posted Top 5 Popular Stocks in Japan that Offer Yutai Gifts where I shared a popular list of yutai stocks. Given the interest received for that post, I created an updated list for 2020 that I would like to share with you. Some of my picks remain unchanged and it wouldn’t be interesting simply just re-introducing the same stocks so I will be doing something slightly different. Rather than ranking the “Top” stocks, I will introduce to you 5 stocks that pay out interesting yutai gifts.

There is a lot of material in Japanese, very often promoted by online brokers or other blogs and newsletters, but I couldn’t find a lot of content in English which is what led me to start this series of of posts.

Continue reading

Furusato Nozei (Hometown Tax Donation Programme) in Japan

If you live and work in Japan, you should definitely be taking advantage of this benefit. Furusato Nozei or Hometown Tax Donation Programme is a system that was introduced by the Japanese government in 2008 to bring back and to promote business in local prefectures. The way it works is that you pick a prefecture or municipality that you want to donate to and in exchange for your donation you will get local produce sent to you. OK, so what’s in it for me you might be asking? The short answer is that you will be entitled to a tax credit equivalent to the donation amount (minus a 2000 JPY portion which is not tax deductible), so with only 2000 JPY you are technically getting goods of superior value for free. Not bad.

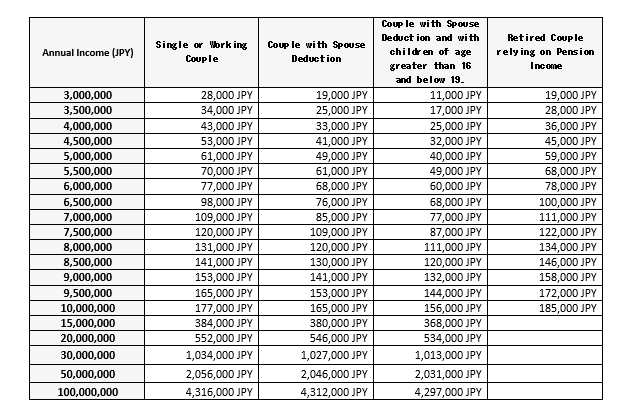

The amount that you can donate will depend on your tax bracket and on other tax credits that you might already be claiming. The below are very rough estimates but they should give you an idea of how much you can expect to claim based on your income tax bracket.

(SOURCE: https://www.furusato-tax.jp/about/simulation#simulation-detail-link-pc)

There are several websites that offer online simulators to help you calculate the exact amount that you can donate. Here are a few that I recommend:

Good Simulator in English

https://en.furumaru.jp/info/simulation.php

Detailed Simulator in Japanese

https://www.furusato-tax.jp/about/simulation#simulation-detail-link-pc

How does it work?

Assuming you went through the above simulators and you have the amount that you want to donate, you can check online shops that allow you to order Nozei Gifts. The below are just some examples that I’ve picked:

- A website in Japanese that provides a ranking of popular Nozei Gifts.

https://furunavi.jp/ranking_total.aspx

- This is the one that I have been using. Unfortunately, it’s only in Japanese but it provides a good selection of products and a user-friendly interface.

These are just a few examples but you can type Furusato Nozei in to any search engine and you will come across numerous results. You will be able to order a wide selection of items:

- Fruit and vegetables from local prefectures

- Holidays to visit your chosen prefecture

- Alcohol

- Clothes

- Pottery

- Sweets

And the list goes on.

Don’t forget to pay by credit card for that extra bit of value.

I have a Rakuten credit that gives me 1 point for every 100 JPY spend. So if I donate 100,000, that’s 100,000 * 0.01 = 1,000 JPY which is nothing to be sniffed at, plus my yearly Furusato Nozei spend helps me maintain Platinum status on my card which comes with added bonuses.

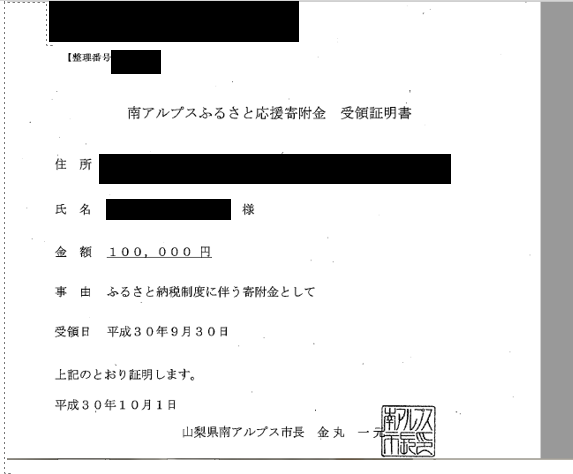

Will I need to file a Tax Return (確定申告)?

You can use the “One Stop Special Exemption” instead of filing a Tax Return. When you pay for your gift the prefecture will send you a thank you letter via post in addition to proof of your donation. Ensure to keep this in a safe place as it might be required in the future. In addition to this, you will also receive a form that will allow you to request the “One Stop Special Exemption”. Basically, if you tick yes to this and send the relevant documents, the prefecture will automatically declare your donation to your local tax authority so you don’t need to declare it yourself. The relevant documents are: (1) a scan of your My Number Card/Notification Card (2) a scan of an authorised document (passport, resident card, insurance card etc.), you will see in your form what documents are allowed so make sure to read that to avoid having to send documents back and forth. To note that if you have to file a Tax Return for other purposes (which was my case), you WILL need to declare your gift in order to get your tax deduction. This is when your proof of donation document is required. If you declare your donation in your Tax Return you will need to post the original certificate of receipt for your donation (make sure to take a scan before sending the original). I have scanned below the receipt that I got so you can see what one looks like:

Now that you have done the hard work, the next step is to enjoy the gifts that you will receive via post. As for the tax deduction, you will reap the rewards in the form of a tax deduction from the income tax and resident tax in the following fiscal year.

I hope you find this post useful and if you have any questions please feel free to post them in the comments section. Thank you for reading.

Top 5 Popular Stocks in Japan that Offer Yutai Gifts

Yutai Gifts 株主優待 (Kabunushi Yutai) are perks that companies give to their shareholders as a form of gratitude for owning their stocks. These gifts are often tied to the product or service that the company provides. A lot of retail investors find Yutai investing appealing and there are numerous websites in Japanese that summarise and rank these Yutai offerings. I have done my own bit of research and I have come across quite a few companies that provide competitive rewards. Over the months I have created my own list of popular Yutai stocks that I would like to share with you.

How do I receive my Yutai Gift?

Before we get started with our top 5 list, you might be asking what is required to be eligible to receive these gifts.

- You will need a brokerage account in order to purchase the stocks. For guidance in opening up a brokerage account in Japan, please refer to this article.

- Purchase the stock and hold it until the relevant ex-right date (the date on which you are eligible for the gift if you are the shareholder).

- You will receive your Yutai Gift via post (most companies have a detailed description on their website regarding the Yutai Gift timings so you will be able to check online the exact dates of when you can expect to receive your rewards.

Now, let’s get started. All share prices are based on closing prices of 16th May 2019.

Company Profile: Skylark Group runs numerous family restaurant chains in Japan. Gusto and Jonathan’s were the two restaurants that I was aware of but their brand portfolio seems quite extensive and includes a wide range of cuisines. You can find a list here.

Gift: Coupons that can be used across their restaurants. Every 6 months you will receive 3,000 JPY worth of coupons so that’s 6,000 JPY per year just in coupons which isn’t that bad (these coupons are relatively easy to sell online or at ticket shops like Daikokuya.

Minimum Shares Required: 100 shares

Investment Amount: 100 * 1868 = 186,800

(4) Japan McDonald’s Holdings (2702)

Company Profile: McDonald’s needs no introduction; their burgers are widely consumed around the world and Japan is no exception.

Gift: You get the below booklet which has 6 sheets. Each sheet has 3 coupons which can be exchanged for 1 burger, 1 side and 1 drink or dessert of your choice. I have seen people assigning different values to this coupon. Some people came up with their valuations by picking the most expensive items on the menu that they can order, which brings the monetary value of a booklet close to 7000 – 8000 JPY. I have seen more fair estimates which value this coupon at around 5000 JPY.

Minimum Shares Required: 100 shares

Investment Amount: 4880 * 100 = 480,000 JPY

(3) ANA Holdings (9202) / JAL (9201) ( (I put both airline companies together as what they have to offer is pretty similar in my opinion).

Company Profile: JAL and ANA are the two biggest domestic airlines in Japan and are with well established internationally.

Gift: 50% off domestic flights. Considering domestic flights can range from 20,000-50,000 JPY, you are looking to save 10,000 – 25,000 JPY on your travel fare. Similarly to other Yutai Gift tickets you will be able to easily sell them online.

Minimum Shares Required: 100 shares (to note that the number of free tickets increases as the number of shares increase). For JAL this website (in Japanese) has a good summary of the benefits, there are also added bonuses such as additional coupons for holding the stock for 3 consecutive years.

Investment Amount: ANA (3,750 * 100 = 375,000 JPY) JAL (3,607 * 100 = 360,700 JPY)

(2) Oriental Land Co. Ltd (4661)

Company Profile: Headquartered in Urayasu, Oriental Land runs Disney Land and DisneySea, two very popular theme parks in Chiba. In addition to its theme park business, the company also manages a number of hotels including the Disney Ambassador Hotel.

Gift: 1 free entry pass for either Disney Land or DisneySea (entry price for adults is 7,400 JPY). If you are a fan of Disney and their theme parks I could definitely see the appeal for this gift. Alternatively the coupon can also be easily sold online as there is huge demand for it.

Minimum Shares Required: 100 shares

Investment Amount: (12,935 * 100 = 1,293,500 JPY)

(1) Aeon (8267)

Company Profile: Aeon runs a large chain of supermarkets across Japan and Asia. If you hold their shares you will be sent their “Owner’s Card”. This will entitle you to claiming 3% cash back on your purchases made in cash or via Aeon credit cards (please note that purchases made with non-approved credit cards will not be counted) at their stores. If you regularly do your shopping at Aeon the cash back becomes quite appealing. Similarly to other Yutai gifts, you will entitled to cash back every 6 months. For example, let’s say that over the past 6 months you spent 500,000 JPY at Aeon, your cash back amount will be 500,000 * 0.03 = 15,000 JPY. Considering the stock trades at around 2000 JPY, that’s 15,000/200,000 = 7.5% yield and we are not even including dividends.

Gift: 3% cashback card.

Minimum Shares Required: 100

Investment Amount: 1989 * 100 = 198,900 JPY

What are your top picks? Have you come across any good stocks with Yutai gifts? Please post your top picks in the comment section. Thank you for reading.

Opening a Brokerage Account in Japan

Before you continue reading I assume that you are a resident in Japan as you will have to submit proof of residency when opening up a brokerage account with a Japanese broker. When I was looking to open up an account a few years ago, I was surprised by the lack of online information in English so I hope some people find this content useful. You will still need to have some level of understanding of Japanese in order to navigate the registration forms; unfortunately a lot of the information is still in Japanese.

This may sound like a slight digression but if you are based in Japan as an expat it’s very likely that you will have been contacted by private advisers soliciting you to open up a retirement account with them. While I could see why certain people might benefit from their services, if your aim is to invest whilst minimising costs and you intend to stay in Japan for a while I would personally stay away.

Selecting a Broker

Firstly, you will need to choose from one of the many Japanese online brokerage firms, the so called ネット証券 (Netto Shoken) which are widely used by retail investors as their fees are very competitive. Their offerings are all quite similar based on what I’ve seen. Their products range from individual stocks, FX, options and futures, bonds and commodities. Below is a list of some of the most popular firms:

– Kabu.com

I also came across the below website that ranks these companies based on different metrics (please note that the website is in Japanese):

Having done my own research I opted for SBI Securities which has a good balance between low fees and positive client feedback. Although this is a very rough overview, these are the steps involved in opening up an account.

1) Fill out the online application form. You will need to provide your personal details such as your “My Number” info for tax purposes, personal address and documents (Passport, Residence Card, Insurance Card). You will also need to go through the terms and conditions and provide some details regarding your current occupation and investment experience. Filling out the form can take from 5-30 minutes. If you are employed, I assume that you have done your own research to ensure that you are not in breach of company policy. If you are not sure I would strongly recommend checking with your internal compliance team.

2) If you filled out your form correctly and your application was successful, you will get confirmation via post and a request to provide paper scans of documents such as your passport and My Number Card. Once you post the required information your account should be active within 3-4 business days.

3) Now that your account is active you need to transfer money in and this can be done in several ways. Many of the online brokers also offer banking services so you could open a bank account with them and transfer funds between your bank account and brokerage account. You can even ask them to issue a cash card (see below picture) that will allow you to deposit and withdraw money via ATM machines at convenience stores.

Opening a NISA (Nippon Individual Savings Account)

If you have gone through the above steps you should definitely also open up a NISA. This is the Japanese equivalent of a stock ISA in the UK. The account allows you to invest up to 1,200,000 JPY tax free in a single tax year. The amount that you invest will be tax free for 5 years meaning that if you keep investing the maximum amount for 5 years you will end up with 6,000,000 (5*1,200,000) in a tax sheltered account. This is what they call a 一般(General) NISA. The second type of NISA is a 積立 (Periodic Investment) NISA, which allows you to invest 400,000 JPY per year but extends your tax exemption period to 20 years.

SOURCE: Japanese FSA

Taxes

Investments that are not part of your NISA will be subject to taxes and your broker will give you two options: the first option is to keep your investments in a “Special Account” (特定口座). I strongly recommend this as you will not have to go through the hassle of filing out a tax return (確定申告). Instead your taxes will be automatically deducted from your trading platform. Dividends paid into this account will therefore be paid net of tax. The other option instead is to use a “General Account 一般口座” where any gains and dividend/interest payments will be paid pretax, however you will need to declare this source of income in your yearly tax return form.

Disclaimer:

I am not affiliated with any of the companies that I mentioned in this article. Please invest responsibly. Investment returns can fluctuate and I cannot be held responsible for any losses.